Real estate investing means buying property to make money. It can give income from rent or profit when selling. It is a way to build wealth over time.

Many people want financial freedom and security. Real estate investing can help reach that dream. It is a path that grows stronger with time.

In the U.S., real estate investing is very popular. It includes homes, apartments, and land. Investors choose it for steady income and long-term value.

Understanding Real Estate Investing

At its core, real estate investing means purchasing property to earn a return, either through rental income, property appreciation, or both. In the U.S., real estate has consistently created millionaires because it combines steady cash flow with the ability for assets to grow in value over time. For example, someone who purchased a home in Austin, Texas for $150,000 in 2005 could now sell that same home for more than $400,000 due to population growth and strong demand.

Real estate investing is not a get-rich-quick scheme. It requires research, patience, and long-term vision. It is also not limited to owning rental houses. It can include commercial spaces, industrial warehouses, and even raw land. For beginners, understanding these categories is the first step to making informed decisions.

Basic Concepts of Real Estate

Several key concepts form the foundation of real estate investing. Equity is the portion of the property you truly own after subtracting any loans. Appreciation refers to the increase in a property’s value over time. Cash flow is the net income you receive after paying expenses such as mortgage, insurance, and property taxes. Leverage is using borrowed money, often through a mortgage, to purchase real estate, allowing investors to control larger assets with smaller amounts of personal capital. Finally, ROI (Return on Investment) measures profitability by comparing the investment’s cost with the income it generates.

To understand these concepts better, consider a beginner investor who purchases a $200,000 rental home with a $40,000 down payment. If the property generates $1,600 in monthly rent and expenses total $1,200, the investor enjoys $400 in monthly cash flow. Over time, as the property appreciates and the mortgage is paid down, both equity and wealth grow.

Why Invest in Real Estate?

Real estate offers multiple benefits that make it attractive to U.S. investors. One of the strongest reasons is long-term wealth building. Property values in many American cities rise steadily over time, creating financial security. Real estate also provides diversification, meaning it balances the risk of having all investments in one place, like the stock market.

Another powerful advantage is the tax benefits available in the U.S. Investors can deduct mortgage interest, property management costs, and even claim depreciation, which reduces taxable income. A unique tool called the 1031 Exchange allows investors to defer capital gains taxes by reinvesting profits into another property, giving them more flexibility to grow their portfolio.

Real estate also acts as a hedge against inflation. As the cost of living rises, so does rent. This means that properties continue to generate higher income while protecting the investor’s purchasing power.

Common Misconceptions

Many beginners believe that real estate investing is only for the wealthy. In reality, there are financing options that make it possible to start with relatively little money down. Another misconception is that real estate always guarantees profit. Like any investment, there are risks, and success depends on careful market research and smart decision-making.

Some think property management is effortless, but owning rentals often requires dealing with tenant issues, repairs, and legal compliance. However, in the U.S., property management companies are widely available to handle these responsibilities for a percentage of rental income. Understanding these realities helps beginners set realistic expectations.

Types of Real Estate Investments

There are several categories of real estate investments in the United States. Each type comes with unique opportunities and challenges, making it important for beginners to understand the differences.

Residential Real Estate

Residential properties include single-family homes, townhouses, condominiums, and multi-unit apartments. These are often considered the easiest entry point for beginners because they are familiar and relatively simple to manage. A common strategy is purchasing a rental home and leasing it to tenants for long-term income. Another growing trend is short-term rentals through platforms like Airbnb, which can generate higher returns in tourist-heavy cities like Orlando or Las Vegas.

Commercial Real Estate

Commercial properties include office buildings, retail centers, and large apartment complexes. While they often provide higher rental income, they also require larger investments and more experience. For example, a strip mall in a busy suburban area can generate strong rental revenue from multiple tenants, but it can also sit vacant during economic downturns.

Industrial and Land Investments

Industrial properties such as warehouses and distribution centers have become increasingly valuable with the rise of e-commerce in the U.S. Giants like Amazon lease massive warehouses to meet online shopping demand, which creates opportunities for investors. Land investments involve purchasing undeveloped property with the expectation that it will appreciate in value as surrounding areas develop. In fast-growing states like Texas and Florida, land banking is a common strategy.

Evaluating Real Estate Market

Knowing where and when to invest is just as important as knowing what to invest in. Evaluating the real estate market involves analyzing demand, growth patterns, and economic health. In the U.S., factors such as job creation, new infrastructure, and population growth are critical signals of market strength. For example, cities like Austin, Nashville, and Raleigh have seen real estate booms because of technology companies moving in and creating high-paying jobs.

Market Research

Researching the real estate market means gathering reliable data. Popular U.S. sources include Zillow, Redfin, Realtor.com, and the U.S. Census Bureau. Investors should study property values, rental rates, neighborhood crime statistics, and school district ratings. A property in a safe area with good schools is more likely to attract long-term tenants and appreciate in value.

Identifying Growth Areas

Growth areas can be identified by looking at urban development, new infrastructure projects, and migration trends. For instance, cities experiencing an influx of tech workers often see rising housing demand. Suburbs near major cities are also growing rapidly as remote work becomes more common, creating fresh opportunities for investors.

Analyzing Market Trends

Trends such as interest rates, housing affordability, and rental demand provide insights into whether it is the right time to buy. When mortgage rates are low, more people can afford homes, which pushes property values upward. Conversely, when interest rates rise, rental demand often increases as fewer people qualify for mortgages. Investors must watch these trends closely to make smart decisions.

Financing Your Real Estate Investment

Financing is one of the most important aspects of real estate investing. Most beginners in the U.S. cannot afford to buy properties with cash, which is why financing options are crucial.

Traditional Mortgages

Traditional mortgages are the most common method of financing residential real estate. They typically require a down payment of 20 percent, although government-backed loans such as FHA loans allow qualified buyers to put down as little as 3.5 percent. Mortgages spread the cost of a property over decades, making real estate accessible to average Americans.

Alternative Financing Options

For those who do not qualify for traditional mortgages, alternative financing options exist. Hard money loans are short-term, higher-interest loans often used by house flippers. Private lending, real estate partnerships, and crowdfunding platforms are also growing in popularity. These options allow beginners to start investing without meeting the strict requirements of banks.

Tips for Securing Loans

Securing a real estate loan requires good credit, a stable income, and manageable debt levels. Lenders in the U.S. typically look for a credit score above 620 for conventional loans. Beginners should focus on improving their credit, reducing debt, and saving for a down payment before approaching lenders.

Read Also : Character AI Old – The Complete Guide to Legacy Versions

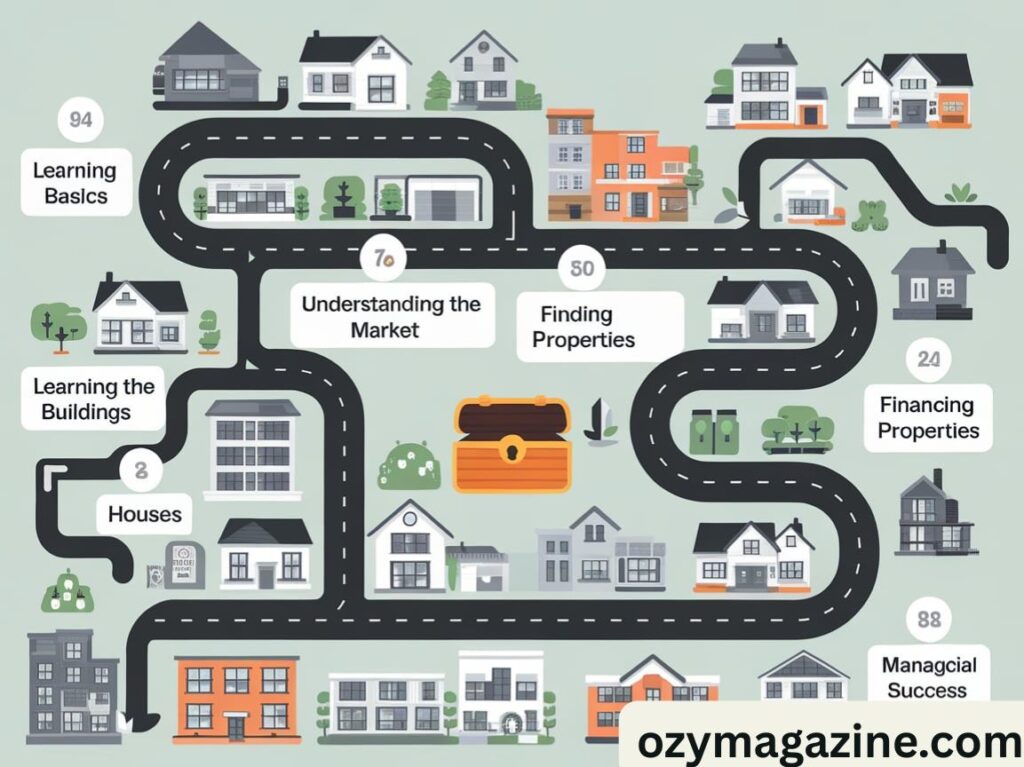

Steps to Begin Investing

Starting your real estate investing journey in the U.S. requires careful planning. The first step is setting clear investment goals. Are you looking for monthly cash flow, long-term appreciation, or a mix of both? Once goals are set, the next step is building a diverse portfolio to reduce risk. For beginners, this could mean starting with one rental home and gradually expanding into commercial or land investments.

A common beginner strategy is starting with small investments such as a single-family rental property or a duplex. This allows new investors to learn how property management, financing, and tenant relationships work without being overwhelmed by large-scale projects. Over time, profits can be reinvested into larger opportunities, creating a cycle of growth.

The Importance of Location in Real Estate Investing

Location is often called the golden rule of real estate investing because it directly influences property value, rental demand, and long-term appreciation. In the U.S., cities with strong job markets, growing populations, and good infrastructure tend to deliver the highest returns. A property in the right location can outperform similar investments in weaker markets.

For beginners, researching neighborhood features such as school quality, public transportation, safety, and access to amenities is crucial. A home in a well-connected suburb or a developing area can attract long-term tenants and generate consistent income. Investors who prioritize location often find their properties appreciate faster, making it easier to build wealth and reinvest profits into future opportunities.

The Role of Property Management in Success

Many beginners overlook property management, yet it is one of the most important parts of real estate investing. Managing tenants, repairs, and legal compliance requires time and knowledge. Investors who neglect these responsibilities risk high vacancy rates, legal disputes, or declining property values, which can quickly erase potential profits and create unnecessary stress.

Hiring a professional property manager can solve these problems. In exchange for a small percentage of rental income, managers handle tenant screening, maintenance, rent collection, and legal issues. This allows investors to focus on strategy and growth rather than daily operations. In the U.S., property management companies are widely available, making it easier for beginners to scale investments.

Building Wealth Through Long-Term Strategies

Real estate investing rewards those who think long term rather than chasing quick profits. Holding properties for years allows investors to benefit from appreciation, steady rental income, and tax advantages. Over time, mortgages are paid down, equity builds, and wealth compounds, creating financial security that few other investments can match in the U.S. market.

Beginners can start small and grow gradually by reinvesting profits into new opportunities. For example, starting with a single rental property can lead to acquiring a second, then a third, creating a diverse portfolio. This slow, consistent approach not only reduces risk but also teaches valuable lessons along the way. Long-term strategies remain the foundation of real estate investing success.

Conclusion

Real estate investing offers one of the most reliable ways to build wealth in the United States. By understanding the basics, evaluating markets, and using smart financing strategies, beginners can confidently take their first steps into the world of real estate. While challenges and risks exist, the long-term benefits of building equity, generating income, and protecting against inflation make it one of the most powerful investment tools available.

As you follow this Real Estate Investing 101 roadmap, remember that patience, research, and consistent effort are the keys to success. The opportunities are vast, and for those willing to learn and take action, real estate can open the door to lasting financial freedom.